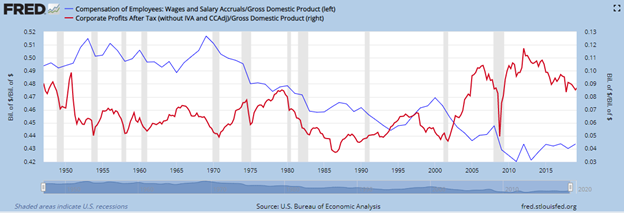

Time for Change- The killing of George Floyd and other recent notable public injustices people of color have experienced remind us of the deep levels of inequality within the US. Hopefully, there will come from these instances a new desire from society to address social issues in a productive way. Capitalism itself in its current form needs to change to remain part of a viable solution. Capitalism has become a license for unbridled materialism for some as profits have been allocated to capital at the expense of labor (see chart “Corporate profits vs GDP compared to wages vs GDP” below). Free market economic theory must be adapted for modern life. There will be public discussion about which “ism” is best suited to address these discrepancies. A new form of capitalism must emerge, one of stewardship, to offer a path to a more just society for all.

COVID in the Wake of May. The month of May brought three major opportunities to test the transmissibility of COVID-19 in the US: Mother’s Day, Memorial Day, and mass protests. Current data suggests potential areas of increased infection include NC, SC, TX, UT, and FL. While in other areas, particularly in the Northeast, the data has been trending down. With protests starting May 29th, Thomas Lee of Fundstrat noted, “~92% of those exposed to COVID-19 are symptomatic by day 14 (50% by Day 7). Day 14 is June 11th. So, if no massive second wave starts by June 11th, we have a definitive break in transmissibility." Given data is increasing and reported with a lag, this story may have a large impact-one way or the other-on markets in the coming weeks.

A Second Wave of the virus would cause an extremely difficult dilemma- refrain from renewed lockdown measures, risking the lives of many, or shut down the economy again, with all the negative impacts that come with it. US Treasury Secretary Steve Mnuchin told CNBC Thursday, “We can’t shut down the economy again. I think we’ve learned that if you shut down the economy, you’re going to create more damage.” Of course, as we learned with reopening, state governments will ultimately make their own decisions.

Stimulus- The CARES Act provided massive fiscal stimulus to bridge the initial hard stop of the economy—actually increasing personal income. While the need for many goods and services fell, demand increased on various home and personal spending and leisure related items such as gym equipment, puppies and campers. And with professional sports shut down, a trend developed in trading stocks of bankrupt of near bankrupt companies, of which Hertz became the most notable example this week. In a surprising twist for Hertz, speculative day traders may end up providing a new lifeline to the bankrupt company. On Friday, Hertz received approval to proceed with an equity offering in which it seeks to raise up to $1B. As Charlie Munger recently observed, “There is a lot of idiocy going on at the moment & mis-behavior and it always creates danger for the unwary.”

I will close here for the week. Have a great weekend.